student loan debt relief tax credit application for maryland resident

These debt relief programs offer solutions by enabling you to. How to apply.

News Release Comptroller Franchot Urges Marylanders To Apply For Tax Credit

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents.

. Under Maryland law the recipient must submit proof of payment to MHEC showing that the tax credit was used for the purpose of paying down the qualifying student loan debt. For example it can help you make minimum payments for debts you have fallen behind on paying. Fielder announced that the application for the Student Loan Debt Relief Tax Credit is now available.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the recipient must. The deadline to apply is September 15th. Make monthly payments to the lender until the amount of the tax credit is paid.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn. A copy of the required certification from the Maryland Higher Education Commission must. To be considered for the tax credit applicants must complete the application and submit student loan.

Financial freedom is a way of life that evades most Nevadans today and like many others across the country most are saddled with debt. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are. This tax credit could be of great benefit to Maryland taxpayers with student loans.

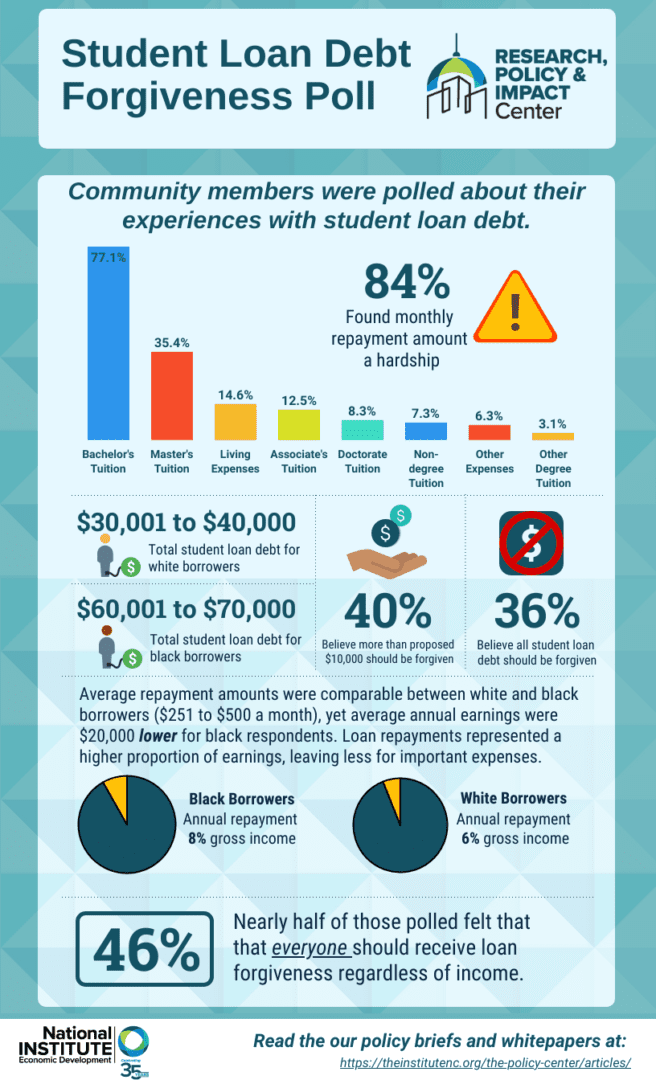

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. Developing a debt relief plan can give you renewed hope of managing your debt. Administered by the Maryland Higher Education Commission MHEC the credit provides a refundable tax credit cash payment that a tax filer applies directly to their student loan balance.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. 2 days agoThe Biden administration has agreed to fully discharge the federal student loan debts of approximately 200000 borrowers who claimed they were defrauded by their college but whose applications for. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt upon applying for the tax credit.

MHEC will prioritize tax credit recipients and dollar. From July 1 2022 through September 15 2022. The application period is July 1 to September 22 of.

Student Loan Debt Relief Tax Credit. Make a one-time payment for the amount of tax credit to lender. Student loan debt relief tax credit for tax year 2021.

Many Kentucky residents who are experiencing financial challenges seek debt relief options to ease their burden. Student Loan Debt Relief Tax Credit. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying.

Maryland Student Loan Debt Relief Tax Credit Application Last modified by. The Maryland Higher Education Commission secretary James D. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

Find Your Path To Student Loan Freedom. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. MD Higher Education Commission.

Student Loan Debt Relief Tax Credit Application. Lifetime learning places no limit on the number of years a credit can be claimed. For Maryland Resident Part-year Resident Individuals.

The Homestead Tax Credit application deadline is October 1st. Debt relief programs are available in Kentucky to help consumers struggling to pay off their credit card and personal loan debt. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate.

Lower your monthly payments. The tax credits. Student loan debt relief tax credit individuals that have at least 20000 in undergraduate or graduate student loan or both debt may qualify for the credit.

Currently owe at least a 5000 outstanding student loan debt balance. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. Student Loan Debt Relief Tax Credit.

Maryland residents who have significant student loan debt may benefit from a Maryland tax credit program. In the case of a fiduciary return the fiduciary will complete the column for Taxpayer B only. Over 3 million people live in the western state which has seen a drop in unemployment.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher. In an effort to streamline the. The application will close September 15 2021.

The Student Loan Debt Relief Tax Credit is a program created under 10 -740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who. The 2019 Student Loan Debt Relief Tax Credit Application Process is now open. However statistics show a debt increase of 35 percent from 101727 in 2020 to 105281 in 2021.

As Marylands Comptroller I want to make sure all taxpayers have the information they need to receive any tax relief possible. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Use the rules for filing separate returns in Instruction 8 of the Maryland resident tax booklet.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. September 9 2019 - 704 am. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application. Other options enable you to reduce the total debt or interest rates.

Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least 20000 in undergradgrad loan debt and still have 5000 outstanding. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified. The Deadline for the Student Loan Debt Relief Tax Credit is September 15.

Biden Is Already Backtracking On His Promises To Provide Student Debt Relief Astra Taylor The Guardian

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Forgiveness May Come With A State Income Tax Bomb

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Dc News Now

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Maryland Student Loan Forgiveness Programs

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Maryland Student Loan Debt Relief Tax Credit

What Is Tax Relief The Kansas City Star

New York Debt Relief Programs Get Nonprofit Help For 2 100k

Is Student Loan Forgiveness Taxable In 2022 It S Complicated

Alaska Student Loans Debt Statistics Student Loan Hero

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

Learn How The Student Loan Interest Deduction Works

Time Is Running Out To Apply For The Maryland Student Loan Tax Credit